Table Of Content

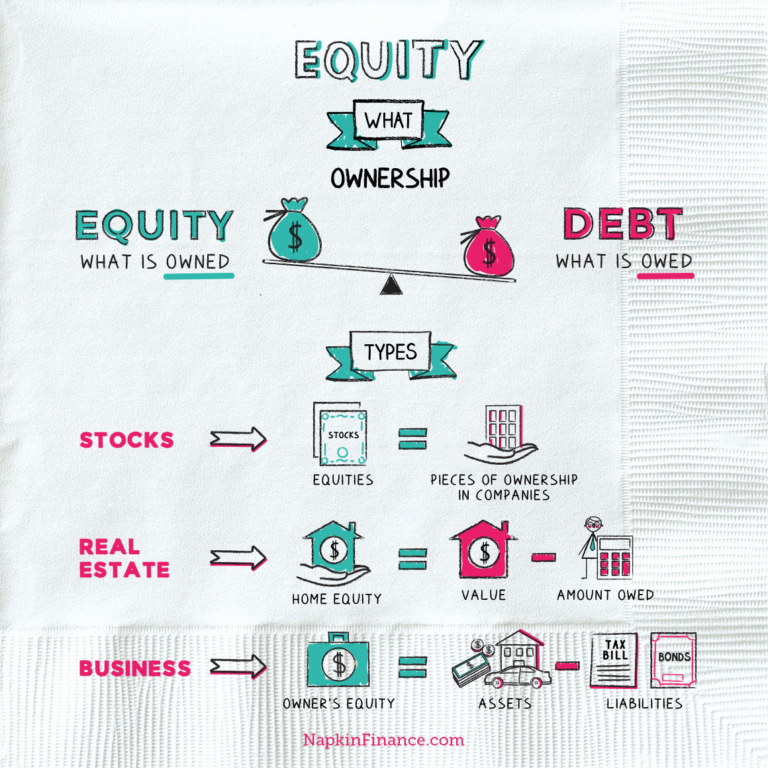

Rocket Mortgage® is now offering the Home Equity Loan, which is available for primary and secondary homes.1 We'll speak about the qualifications throughout. Homeowners who stay in their homes longer are more likely to accrue equity. Home equity is an asset and is considered part of your net worth.

Step 2: Calculate Your Debt-To-Income Ratio

If you can’t pay back what you’ve withdrawn, the lender could foreclose on your home; therefore, it’s important to act fast if you foresee a problem. Reach out to the lender to understand your options, and consider refinancing to lower your rate or change your payment terms. HELOCs typically have variable interest rates, while home equity loans are usually issued with a fixed interest rate. This can save you from a future payment shock if interest rates rise. Work with your lender to decide which option is best for your financing needs. Before you open a HELOC, you might look for lenders that offer a fixed-rate option.

Applications Now Open for the DOJ National Public Safety Partnership 2024 Cohort

How To Access Home Equity In A Financial Emergency - Bankrate.com

How To Access Home Equity In A Financial Emergency.

Posted: Fri, 05 Jan 2024 08:00:00 GMT [source]

After the draw period, you enter the repayment period, where you must repay all the money you borrowed, plus interest. A home equity loan is money that is borrowed against the appraised value of your home. You receive the funds in a lump sum, and you are require to make monthly payments, as with any other type of loan.

Ways to get the best home equity loan rates

With this big down payment, you may be able to get into a larger, more expensive home because your mortgage will be smaller. And with a smaller mortgage, your monthly payment will be lower, too. You can tap into this equity when you sell your current home and move up to a larger, more expensive one. You can also use that equity to pay for home improvements, help consolidate other debts or plan for your retirement.

How To Get A Home Equity Loan

If you’re concerned about your ability to juggle two mortgages, you may want to choose a cash-out refinance instead. This allows you to have one payment at the lowest available interest rate. A HELOC allows you to borrow money as needed up to the limit of the line of credit for a predetermined length of time. If you’re interested in a home equity loan, the first thing you’ll have to do is figure out how much you need to borrow.

Calculator: 15-year or 30-year Term?

For well-qualified borrowers, the limit of a home equity loan is the amount that gets the borrower to a combined loan-to-value (CLTV) of 90% or less. This means that the total of the balances on the mortgage, any existing HELOCs, any existing home equity loans, and the new home equity loan cannot be more than 90% of the appraised value of the home. For example, someone with a home that appraised for $500,000 with an existing mortgage balance of $200,000 could take out a home equity loan for up to $250,000 if they are approved. Say you have an auto loan with a balance of $10,000 at an interest rate of 9% with two years remaining on the term. Consolidating that debt to a home equity loan at a rate of 4% with a term of five years would actually cost you more money if you took all five years to pay off the home equity loan. Also, remember that your home is now collateral for the loan instead of your car.

Repaying A Home Equity Loan

Of course, the amount of the loan and the rate of interest charged also depend on the borrower’s credit score and payment history. Technically, you have the flexibility to use a home equity loan or HELOC for anything. The funds you receive can be used for a wide variety of purposes, including paying off credit cards, funding home improvement projects or purchasing a vehicle. However, this doesn’t mean home equity lending is the best financing option for everyone. Sometimes, it may make more sense to use a different type of loan or wait until you have enough equity to borrow against. Once the loan closes, your lender will lend this $40,000 in a single payment.

A HELOC is essentially a line of credit that’s usually worth up to 85% of your home’s value minus the remaining balance of your mortgage. In reference to the above example, your bank may let you take out a $225,000 HELOC (85% of $500,000 – $200,000). Home equity is literally the amount of a home that you own versus the amount that is still owned by the bank through a mortgage.

Will taking out a home equity loan hurt my credit score?

If you need to borrow a larger amount of money, you might be able to take out a secured loan against your home equity. Sometimes these are referred to as a homeowner loan or as a second charge mortgage if you already have a mortgage on your property. These options may be worth exploring if you’re finding it difficult to get a personal loan, although your property is at risk if you don’t keep up with repayments. Remember that because you’re paying off your old mortgage with a larger loan, your monthly payments will increase. Many homeowners believe that selling their house is the easiest and most convenient way to get a needed cash influx. However, accessing your home equity can be a smart way to borrow—without having to sell your home, take out expensive personal loans, or rack up credit card debt.

A key way to use your current home’s equity to buy another home through a home equity loan. With this type of loan, you’ll receive the funds as a lump sum to use as you wish—such as to purchase a second home or investment property. Miranda Crace is a Senior Section Editor for the Rocket Companies, bringing a wealth of knowledge about mortgages, personal finance, real estate, and personal loans for over 10 years. Miranda is dedicated to advancing financial literacy and empowering individuals to achieve their financial and homeownership goals. She graduated from Wayne State University where she studied PR Writing, Film Production, and Film Editing.

Learn the difference between a home equity loan vs. a home equity line of credit. Or you can first learn more about the common ways to use your equity. If you have medical expenses you can’t pay, borrowing against your home equity could be a wise option.

The reason for this is there is less risk involved for lenders because home equity loans are secured by your home. On the other hand, if you’re unable to keep up with your monthly payments, the lender can foreclose on your home to recoup costs. This is typically between five and 20 years, though some lenders offer terms as long as 30 years. A home equity line of credit (HELOC) is similar to a credit card, acting as a revolving line of credit based on your home's equity. HELOC funds can be used when you need them, paid back, and used again. Often there is a 10-year draw period, where you can access your credit as needed, with interest-only payments.

Unsurprisingly, many borrowers who apply for a second mortgage have an immediate need for the entire balance. The interest paid on a home equity loan can be tax deductible if the proceeds from the loan are used to “buy, build or substantially improve” your home. However, with the passage of the Tax Cuts and Jobs Act and the increased standard deduction, itemizing to deduct the interest paid on a home equity loan may not lead to savings for most filers.

Your equity consists of any down payment made, the portion of the mortgage payment that pays down the principal and any appreciation of the value of the home. If your personal finances are still sound, you might want to stay put and work to build more equity. When you stick with it, you can benefit from the market conditions improving and driving your home’s value back up and you won’t lose money. You can think of your mortgage payments as a type of monthly savings deposit, similar to investing in a long-term asset such as bonds. Although, your money is tied up for now, it's there when you need it. Ashley was a deputy editor for loans and mortgages at Forbes Advisor.

No comments:

Post a Comment